FAIR & LIQUIDATION VALUE UNDER IBC

Valuation under the Insolvency and Bankruptcy Code (IBC) in India is a critical aspect as it determines the value of assets and liabilities of a corporate debtor. The valuation process is crucial for various reasons, including determining the haircut for creditors, assessing the viability of resolution plans, and ensuring a fair distribution of assets during insolvency proceedings.

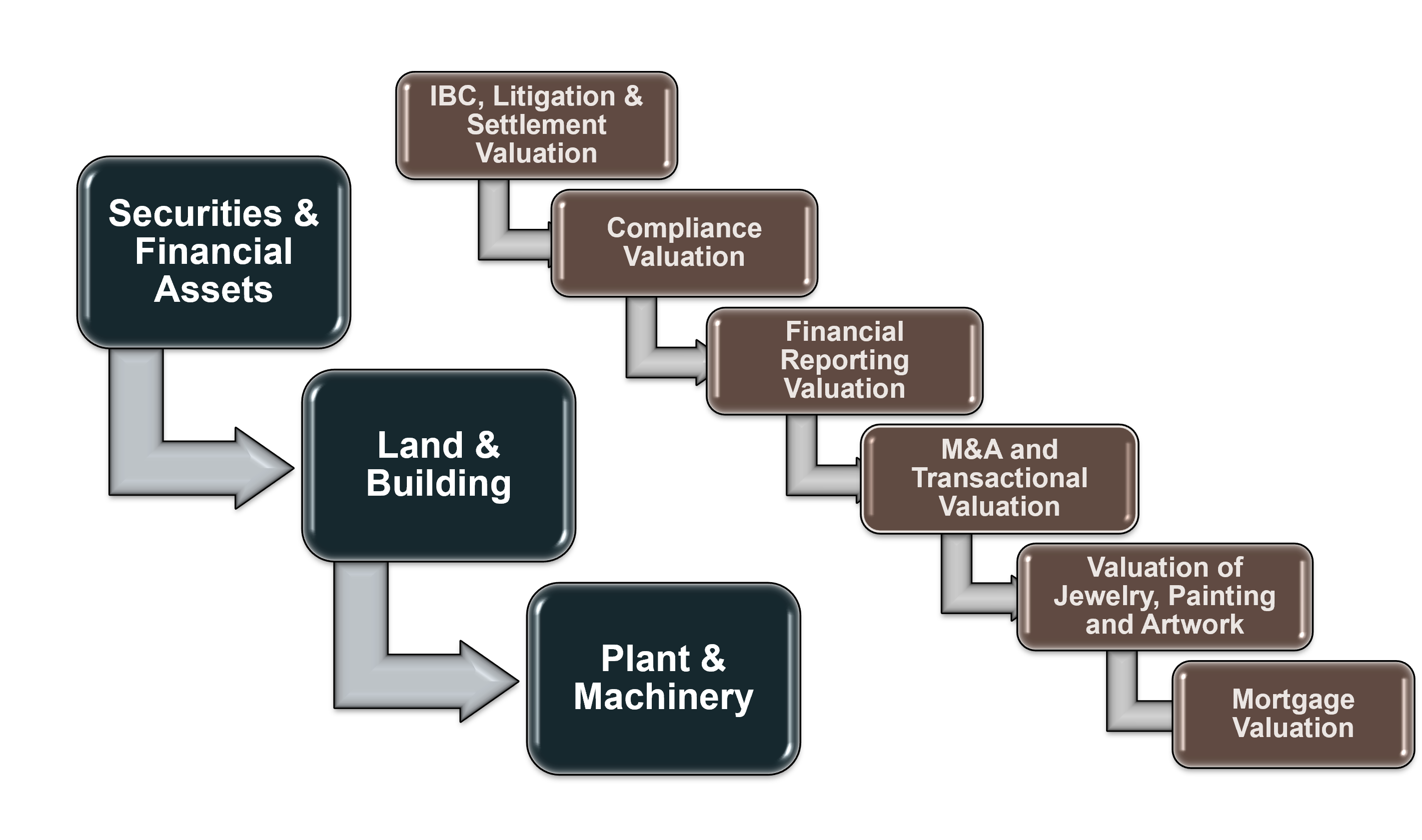

We have a team of registered valuer in all three-asset class i.e. Land & Building, Plant and Machinery and Securities & Financial Assets, who have assisted RPs and liquidators in more than 100 IBC cased. Our team specialises,

- Estimation of Fair and liquidation value for all three assets classes as per regulation 35

- Estimation of liquidation value for all three assets classes as per regulation 32 (a) to (f)

LITIGATION VALUATION

The conflicts associated with commercial, shareholder and disputes can involve loss of business reputation, economic value, loss of profit, bankruptcy, stakeholder disagreements, minority shareholder oppression post-merger and acquisition disputes, not to mention loss of time and precious financial resources.

At Armslength, we help our clients to resolve such issues by providing expert and unbiased valuation opinions. Our in-depth study of data can help to determine fair valuations to allow for smooth and timely resolution of cases.

Our Litigation and Settlement valuation services includes valuation for the purpose of

- Commercial and Shareholder Disputes

- Family Settlement and Partition

- Matrimonial disputes Settlement

Our experts can also bear testimony as expert witness for the same in a court of law.

FINANCIAL REPORTING VALUATION

In an environment of increasingly complex fair value reporting standards and increasing regulatory scrutiny, Armslength helps clients resolve financial reporting valuation issues successfully.

With an hands on experience over a decade in handling engagements of fair valuation opinions in compliance with IFRS, US GAAP, FRS Singapore and Ind AS, the team at Armslength is well versed in providing practical and implementable solutions to its clients.

Our financial reporting valuation services include:

- Purchase price allocation (“PPA”)

- Valuation of employee stock options and restricted stock awards

- Impairment analyses for goodwill, other intangibles and long-lived assets

- Valuation of intangibles like customer relationships, trademarks, technology, patents, databases, domain names, websites, brands, software etc.

- Valuation of financial instruments encompassing derivatives, structured products, foreign currency convertible bonds and preferred stock, guarantees and indemnifications

COMPLIANCE VALUATION

The businesses must always be compliant with valuation rules. If they are not, the result can be significant penalties and costly time spent on correcting the errors.

At Armslength we carry out the following compliance related valuations,

- Valuation for the Companies Act Compliances,

- Valuation for Foreign Exchange Management Act (FEMA) and Reserve Bank of India (RBI) regulations Compliances

- Valuation for Securities and Exchange Board of India (SEBI) compliances

- Valuation for Indirect Transfer under Section 9(1) (i) of Income Tax Act read with Rule 11UB,

- Valuation of issue of fresh shares under the Income Tax Act, 1961 read with Rule 11UA(2)(b),

Our experts can also bear testimony as expert witness for the same in a court of law.

M&A & TRANSACTIONAL VALUATION

A transaction represents a significant event that requires careful management and significant time commitment to achieve expected benefits consistent with timeline expectations. In such cases valuation becomes more critical. We work to help the client derive the maximum benefit from a merger or acquisition transaction by assisting them in estimating the value through a defendable valuation process. We are highly experienced professionals with skills and experience doing the valuation for buying and selling closely-held businesses. We carryout valuations for the purpose of - Business purchase . Business sale, Purchase price allocations (PPA), M&A (Mergers & Acquisition), Reverse merger, Recapitalization, Restructuring, LBO (Leverage Buy Out), MBO (Management Buy Out), MBI (Management Buy In), BSA (Buy Sell Agreement), IPO, ESOPs, Buy back of shares, Project financing and others , Intangible asset / Patent/ Copy right etc , Valuation of distressed asset sale and special purpose assets.

FINANCIAL REPORTING VALUATION

The increasing depth of the Indian Real Estate Industry and growing interest in new instruments, calls for specialized and professional valuation services to assess/understand the impact of Real Estate on financial decisions in addition to fulfilling statutory requirements. The dedicated team our professionals, consisting of certified registered Valuers & civil engineers has been at the forefront in providing specialized and professional valuation services customized to the needs of Private and Public Sector Clients. Our valuation advisory services are provided across a wide array of real estate asset types:

- Vacant land parcels

- Land and built-up premises zoned for residential, commercial, hospitality, retail & entertainment, mixed-use etc.

- Development projects such as Industrial Estates, Residential Townships, Integrated Townships,

- IT/Science/Biotech Parks, Apparel Parks, and Special Economic Zones etc.

- Special-use products such as Golf Resorts, Health Spas etc

VALUATION OF JEWELRY, PAINTING AND ARTWORK

Determining the valuation of jewellery, paintings, and artwork can vary based on several factors such as the artist, age, condition, rarity, and market demand. For jewellery, factors like materials (such as gold, diamonds, etc.) and brand can influence value. Paintings and artwork valuations consider artist reputation, style, size, condition, and whether it's an original or a print. It's important to consult with experts or appraisers specialized in each category to get accurate valuations.

Our team consists of Govt. Registered Valuer and assessor who has acted as valuer for various Govt. departments such as Income Tax, CBI, ED, Maharashtra Police, Economic Offence Wing, Directorate of Revenue Intelligence, Customs department etc. He has been also appointed as registered valuer by various banks and NBFCs like SBI, Kotak Mahindra Bank, Yes Bank, GP Parasik Bank, Model Cooperative Bank, Saraswat bank, Dhanlaxmi Bank, etc.

Our service includes,

- Valuation of gold, silver, platinum, diamond and jewellery,

- precious and semi precious metal,

- Artwork, painting and sculptures